Starta team is launching in a new direction for our US acceleration program!

The accelerator's focus will stay the same — we help international startups to enter the US market by guiding them to scale their business in the US, gain traction on sales, fundraising guidance, and eventually prepare them to go global.

Initially, Starta's main scouting market has been Eastern Europe, but as our company has been growing rapidly, we have been expanding our geography more and more and decided to branch out for pipeline in new exciting markets including Africa.

So why Africa? The venture market for Africa in general and some countries, in particular, has been growing rapidly in recent years. Ecosystems go through a lot of experimentation and in most places where this process has yielded outsize returns, the US venture ecosystem and market have played a crucial role (think SE Asia, India, LatAm). The continent had its first unicorn just two years ago. In contrast, China had its first unicorn in 2010, it took another five years to build another five unicorns in China. But today, China produces tens of unicorns annually. The trend is similar in LatAm, where the first unicorn appeared in 2017 and today it has more than 17 unicorns. This is a trend that we believe will continue in Africa and other emerging markets. Ecosystems develop very slowly, and then super rapidly.

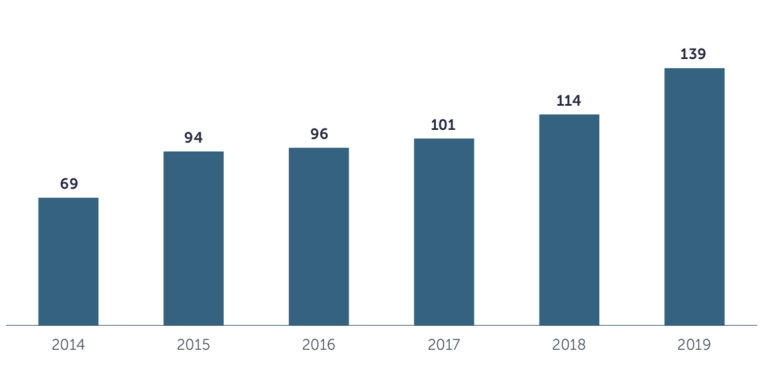

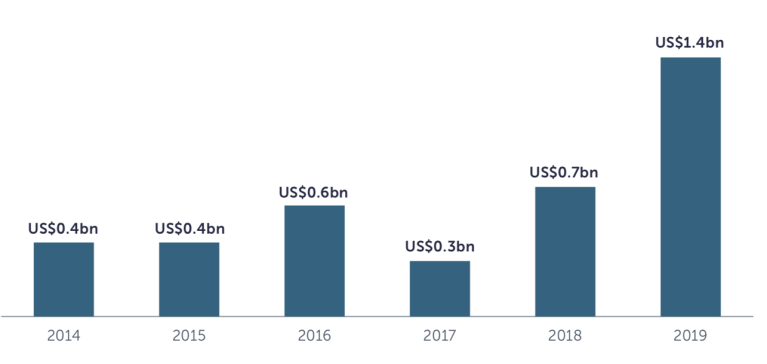

We are witnessing the start of this trend in Africa, and Starta is proud to become an enabler for African startups to supercharge their growth and expand their solutions globally. You can see how the market has developed through 2019 in the bar diagrams below. It can be seen that the value of VC deals doubled in 2019.

Source: African Private Equity and Venture Capital Association, “Venture Capital in Africa: Mapping Africa’s start-up investment landscape,” 2020.

Source: African Private Equity and Venture Capital Association, “Venture Capital in Africa: Mapping Africa’s start-up investment landscape,” 2020.

In 2020, growth has understandably slowed due to the pandemic. The results of various studies for this year vary greatly, so our goal is not to draw overall conclusions but to provide some information and bases of comparison.

According to Partech Africa, African startups raised 2 B dollars in 2020. According to Briter Bridges, 2020 investments amounted to 1.31 billion. Those numbers represent any startup that operates in an African Market. Disrupt Africa research which is based on just companies incorporated in Africa reported $496 million in 2019 and 700 million in 2020. The last report is based on companies incorporated in Africa.

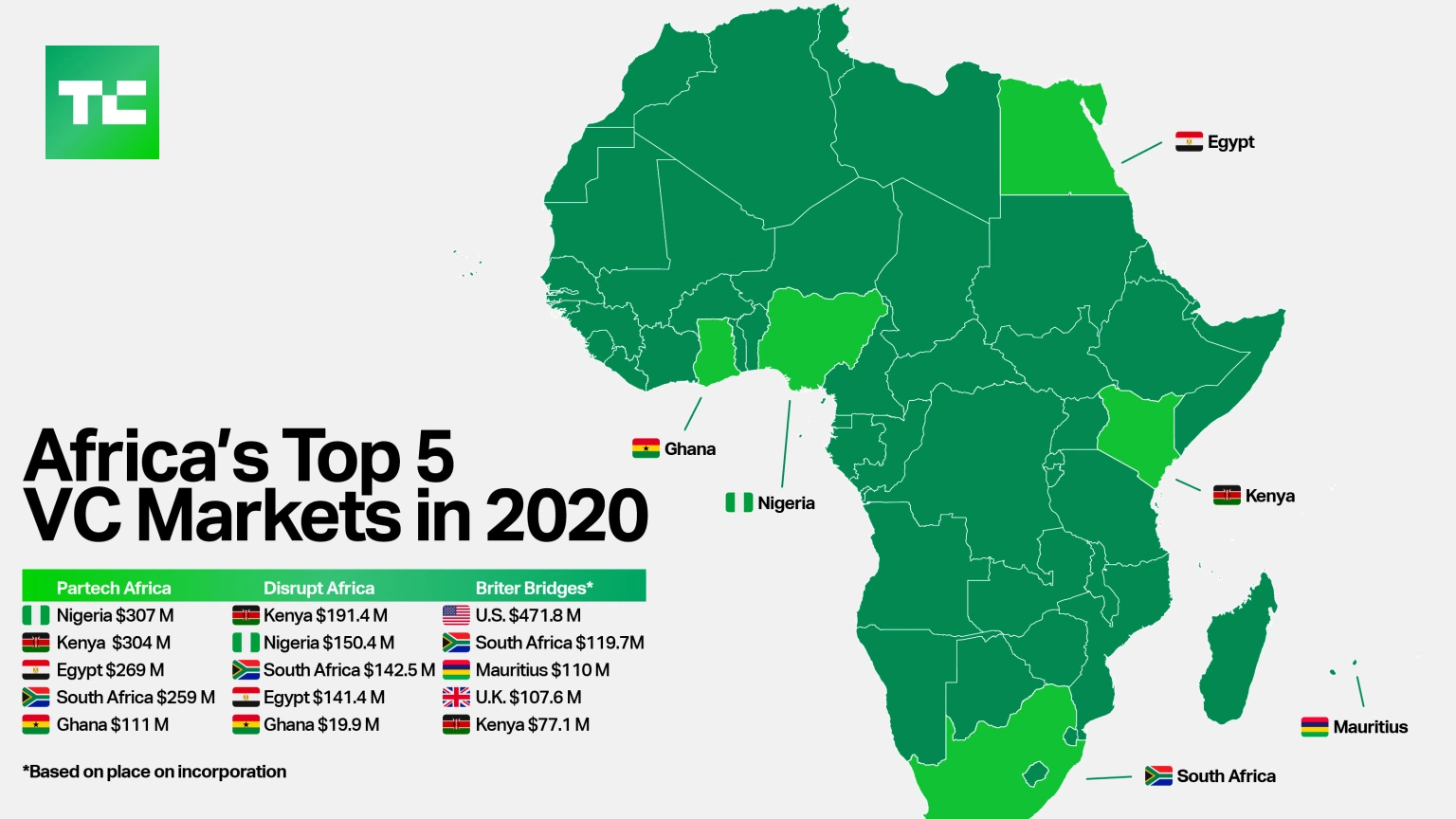

So startups can be incorporated outside of Africa. This brings us to another interesting advantage as a fund investing in US companies from a legal point of view. Below is a graph showing the largest venture markets of Africa.

The results of the first two studies are more or less clear, and Nigeria, Ghana, Kenya, and South Africa have been leading in the innovation and investments field. The Briter Bridges data is even more interesting. They reported that a larger volume of investments goes to companies incorporated in the US and UK, which means that African startups prefer to incorporate and launch in these countries.

So this opens up a number of advantages for us as a fund. Companies initially keep the global market in mind, you can immediately invest in them in understandable and transparent jurisdiction, there are no problems with the transfer of intellectual rights from a local legal entity to an American one. In addition, most African startups initially have all rights registered in the United States.

We would also like to note an important factor — human resources. Africa has a very young population, and according to various studies, by 2050 the working-age population will be larger and younger than in China and India. And even now many young people go to IT, seeing it as the chance for a more promising future.

The situation resembles Eastern Europe, where the lack of upward mobility and a good level of school education made possible the flourishing of IT and the start-up market.

Quantity inevitably turns into quality and coupled with the fact that the previously mentioned countries, the “Big Four” have excellent education levels. We definitely see a gap in the venture and innovation market in Africa.

Therefore, we go to this market and invite all investors and angels who have been interested yet hesitant.

We are also pleased to introduce a new Venture Partner at Starta VC - Adeniyi Adebayo (adeniyi@starta.vc) and Starta Accelerator's Head of African track - Renat Khairullin (rk@starta.vc). For any questions on this topic, please feel free to contact them directly.

Comments

Adeniyi Adebayo: Africa is at the beginning of a worldwide trend, technology penetrates communities and creates more prosperity. We have seen this in America, SE Asia, Latin America, and elsewhere. I believe, this next decade will yield more African startups at scale generating real money value globally.

Renat Khairullin: It really seems to me that the current situation in the African market is similar to what has happened in the post-Soviet countries over the past 20 years when the IT and start-up market has grown incredibly. That's why it is important to take advantage of this opportunity.

Anastasia Lykova, Director of Starta Accelerator: Recently we have been getting more and more applications from startups with African roots and our interest was piqued by all the amazing tech talent coming from there. So we made it our goal to find a partner with passion and expertise in the region so we can asses better and then provide the most value to these companies. Adeniyi joining us was the perfect next step.

PS Startups that want to join our next cohort please apply here.